update on mn unemployment tax refund

Payment errors fraud. Minnesota Unemployment Refund Update.

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned

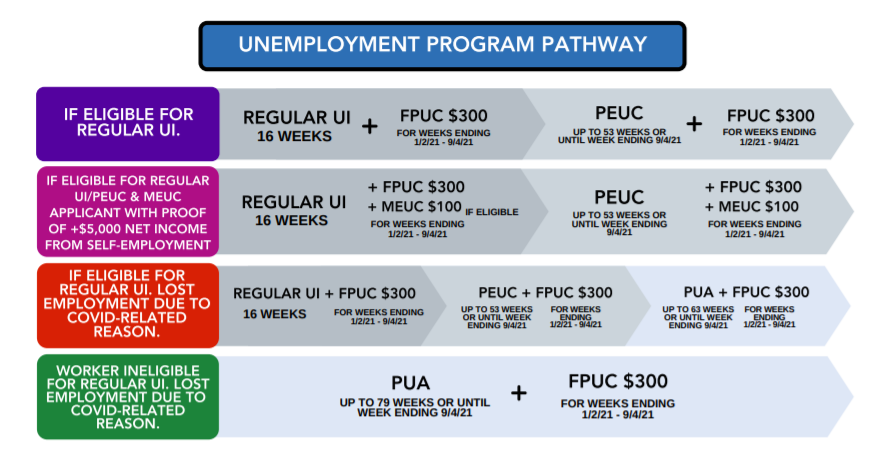

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

. Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically. Minnesota Department of Revenue Individual Income Tax. The Minnesota Department of Revenue.

Your 1099-G will give you the information you need to accurately report your unemployment benefits on your state and federal tax returns including. The dependent exemption amount is 4300 per qualifying dependent. Minnesota Law 268044 Subd1.

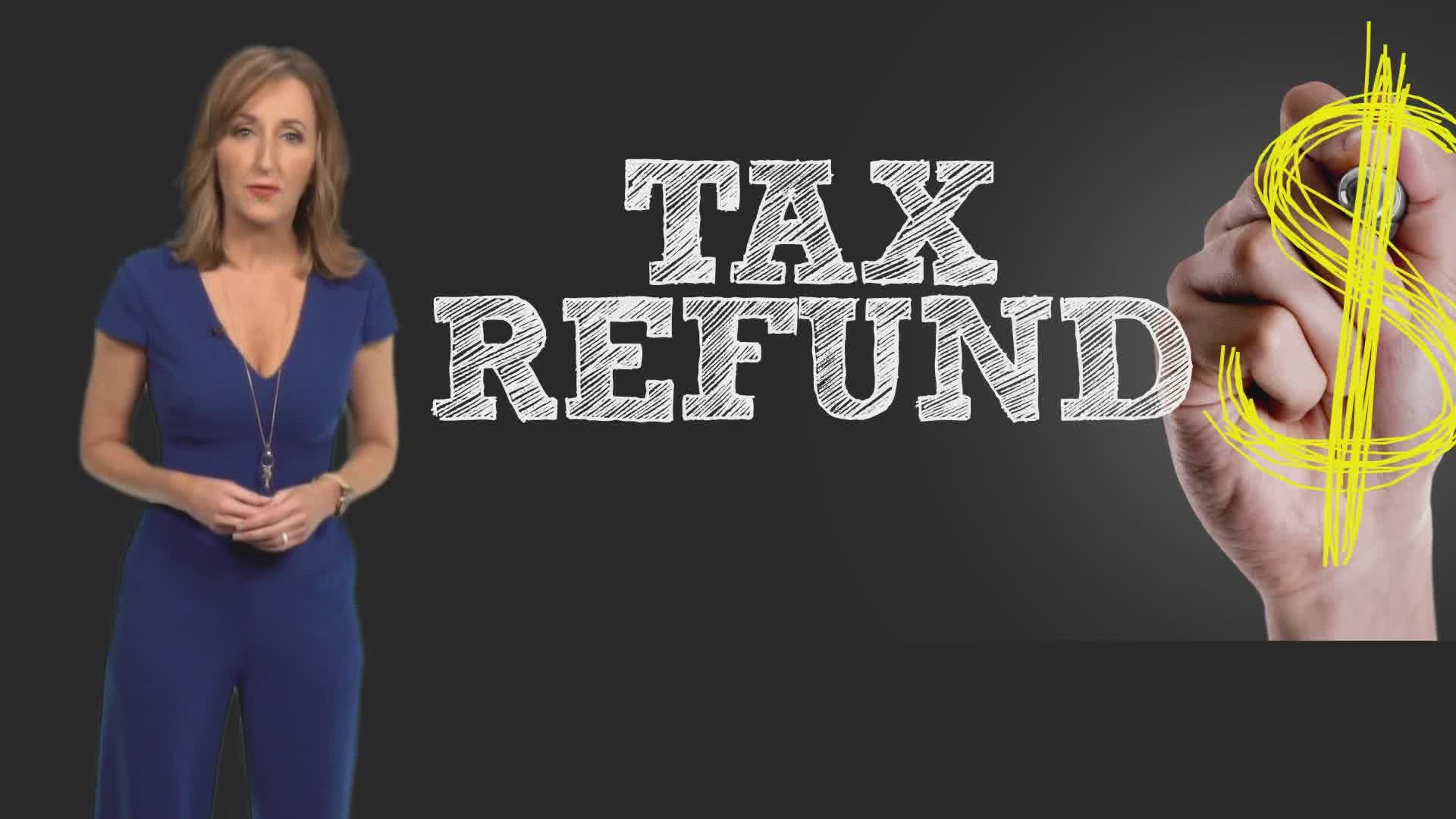

The Minnesota Department of Revenue has confirmed the processing of returns impacted by recent tax changes for those who collected unemployment insurance compensation and Paycheck Protection Program loan forgiveness. News-updates you are on this page Applying after benefit year ends. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said.

Paul MN 55146-5510 Street address for deliveries. Minnesotas Tax Bill Update. Cell phone scams and unauthorized websites.

On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th. I reviewed my returns on March 26th to see how the unemployment exclusion affected my returns. Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks.

Adjusted about 540000 Individual Income Tax returns and issued refunds to taxpayers affected only by the UI and PPP changes. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. Minnesota Department of Revenue Mail Station 0020 600 N.

September 30 2021 249 PM. My Federal refund increased by 75000 as a result of my 710500 Unemployment exclusion. - The Minnesota Department of Revenue announced today that the processing of nearly 540000 tax returns impacted by changes made only to the treatment of Unemployment Insurance UI compensation andor Paycheck Protection Program PPP loan forgiveness is complete.

I have received the 46800 from the state of MN. We know these refunds are important to those taxpayers who have. State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature passed a law affecting COVID unemployment insurance benefits and businesses Paycheck Protection Program payments making them exempt from Minnesota income tax.

Earlier this month Minnesota tax code changes were signed into law with a focus on unemployment compensation Paycheck Protection Program PPP loan forgiveness and other retroactive provisions affecting tax years 2018 through 2020. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

As of January 27 2022 we have. Mail your property tax refund return to. It phases out at certain income levels depending on your filing status.

On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill. Minnesota Covid-19 Tax Refunds Have Begun. Paul MN 55145-0020 Mail your tax questions to.

Year end tax information. Base Tax Rate for 2022 from 050 to 010. Reports must be received on or before the last day of the month following the end of the calendar quarter.

Unemployment benefits are taxable under both federal and Minnesota law. September 13th 2021. Employers with an active employer account must submit a wage detail.

The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans.

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. Thats the same data.

Audit of your account. If you received an unemployment benefit payment at any point in 2021 we will provide you a tax document called the 1099-G. Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point.

Weve finished adjusting 2020 Minnesota tax returns affected only by law changes to the treatment of Unemployment Insurance UI compensation and Paycheck Protection Program PPP loan forgiveness. Additional Assessment for 2022 from 1400 to 000. September 15 2021 by Sara Beavers.

The new law reduces the. 2022 Base Tax Rate changed from 050 to 010 2022 Additional Assessment changed from 1400 to 000. Minnesota Department of Revenue Mail Station 5510 600 N.

It is estimated that more than 540000 Minnesotans are eligible for the COVID-19 tax refunds as a. In the latest batch of refunds announced in November however the average was 1189. My state refund amount decreased by 36300 to a new refund of 10500.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. 51022 at 1230 pm. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13.

As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. About 500000 Minnesotans are in line to get. Unemployment EIDL PPP Loan Forgiveness and More.

The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. The department sent out over 300 million in the form of refunds or a. Married Filing Jointly and Qualifying Widow er.

Ppp Ui Tax Refunds Start In Minnesota

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

Who Gets The Hero Pay In Minnesota Inforum Fargo Moorhead And West Fargo News Weather And Sports

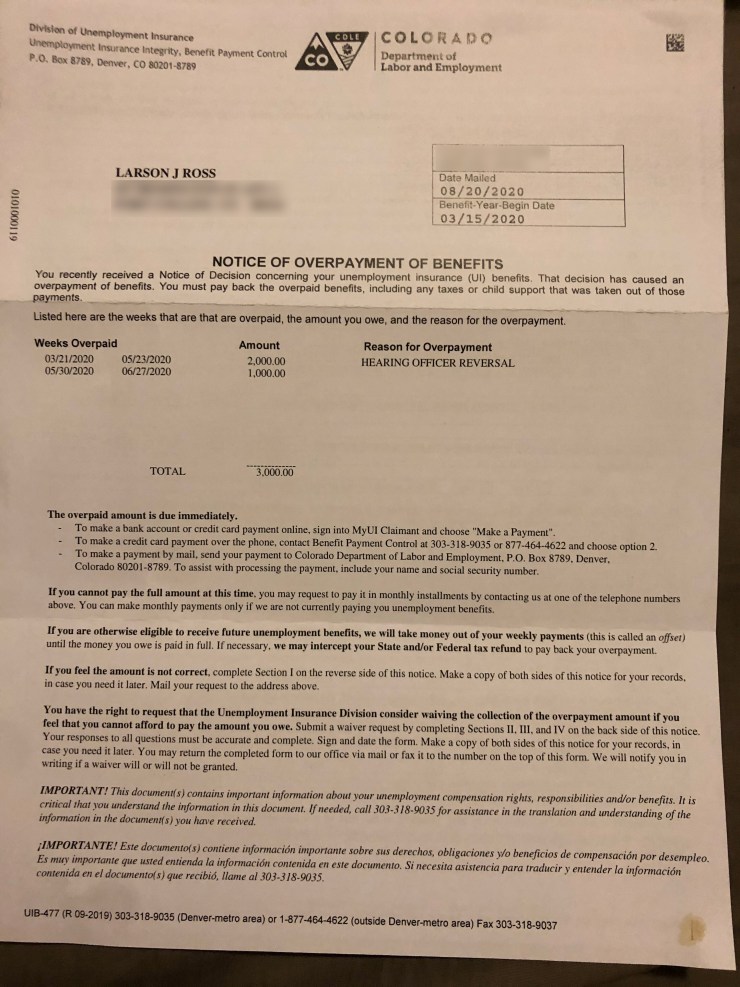

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

House Passes Bill To Replenish Ui Trust Fund Provide Checks To Frontline Workers Session Daily Minnesota House Of Representatives

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned

I Owe Minnesota Unemployment Compensation For An Overpayment Can Bankruptcy Help Walker Walker Law Offices Pllc

Mn Legislature Yet To Reach Deal On Unemployment Insurance Bring Me The News

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

Minnesota Lawmakers Finish Deal On Unemployment Bonuses Www Wdio Com

House Oks Unemployment Insurance Bill With Frontline Bonuses

Dfl Gop Come To Agreement On Unemployment Insurance Frontline Worker Bonuses Bring Me The News

House Oks Unemployment Insurance Bill Kare11 Com

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned

Minnesota Legislature Passes Federal Conformity Bill

State Of Minnesota Passes 2021 Tax Bill Bgm Cpas

Tax Bill Focused On Targeted Cuts Advances In House Session Daily Minnesota House Of Representatives

Unemployment Tax Break Update Irs Issuing Refunds This Week Kare11 Com